Information provided from Share Price Wiki, Stock Market Prices, Stock Market News, Economics Indicators, Commodity Info Heat Maps and of course My Blog

Thursday, 22 September 2011

S&P 500 Closes Above Support

The S&P 500 closed above support finishing at 1129, this is a strong positive for the market, I made a buy trade at 1121.

Support Breached on the S&P 500

1119 was broken on the S&P 500 around 15:25 CET / 20:25 UK time. It's important that the S&P 500 recovers above 1119 at close of the day.....

Global Stock Indexes as Expected Hold at Support Levels

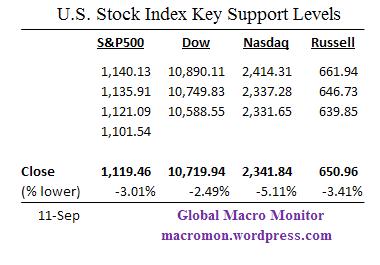

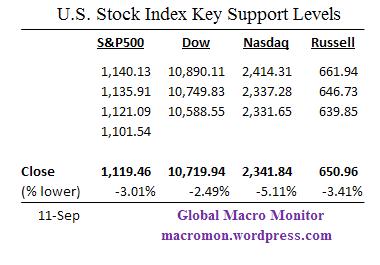

The key support levels shown below (S&P 500, Dow Jones Industrial Average, Nasdaq & Russell 2000) are holding, the key support levels being the 1,121.09 line across the chart below. If we breach 1101 on the S&P 500, sell your stocks and buy back in at 1010. Check live Global Stock Indexes at the end of the Blog.

Banks sell assets after Fed statement

The Fed twist program wasn't enough for the banks, they clearly wanted more free money to repair their balance sheets and pay bonuses for Maserati's. Banks sell the FTSE 100 down 5% along with the German DAX. Basically they're all running for the hills with the stock market profits before other competitor Banks, ensuring what profits they've made is retained. No new money means no money for the banks to deploy to markets, the key test is whether support is broken on the major indices, if so then I suggest you run for the hills also!

Sunday, 18 September 2011

Losses at UBS increase to $2.3bn

Apparently they have now established a special committee, WOHA. Why do these idiots never consider being proactive and have a quality control department before hand monitoring accounts and transactions. For if transactions are monitored they can ascertain whether the traders books are good or bad. In fact are not all trading systems computer driven and thus fully accountable, I'd say YES. You would expect that they account impeccably.

I think what we have here is UBS turning a blind eye so they didn't have to deal with this during the great 2008 crash, or they hoped that his big bets may become good? I think this seems more likely, considering the supposedly new rules introduced by the FSA after the last Barings Bank scandal. But we all know the FSA are as weak as a wet blanket if not corrupted at the top. So I guess the FSA rules where just as ludicrous as the rules which allowed a UK Prime Minister driven light touch credit frenzy from 2002 onwards.

Share prices down next week I think, particulary as we're at the top of the current range and the news is suprisingly turning negative. Surlely not the newspapers working with the banks, that wouldnt happen now would it Mr Murdoch.

I think what we have here is UBS turning a blind eye so they didn't have to deal with this during the great 2008 crash, or they hoped that his big bets may become good? I think this seems more likely, considering the supposedly new rules introduced by the FSA after the last Barings Bank scandal. But we all know the FSA are as weak as a wet blanket if not corrupted at the top. So I guess the FSA rules where just as ludicrous as the rules which allowed a UK Prime Minister driven light touch credit frenzy from 2002 onwards.

Share prices down next week I think, particulary as we're at the top of the current range and the news is suprisingly turning negative. Surlely not the newspapers working with the banks, that wouldnt happen now would it Mr Murdoch.

Subscribe to:

Comments (Atom)